The Universal Quote Builder integrates with the Anrok API for automated sales tax calculations. Users can apply sales tax for quoting and/or billing scenarios. Our flexible builder allows you to use SalesReady + Anrok on any line item object, including but not limited to:

-

Quote (Quote)

-

Opportunity (Opportunity)

-

Order (Order)

-

Work Order (WorkOrder)

-

Service Contract (ServiceContract)

-

CPQ Quote (SBQQ__Quote__c)

-

Billing Invoice (blng__Invoice__c)

-

Invoice (Invoice)

-

B2B / D2C Cart (WebCart)

How to configure the SalesReady + Anrok integration

-

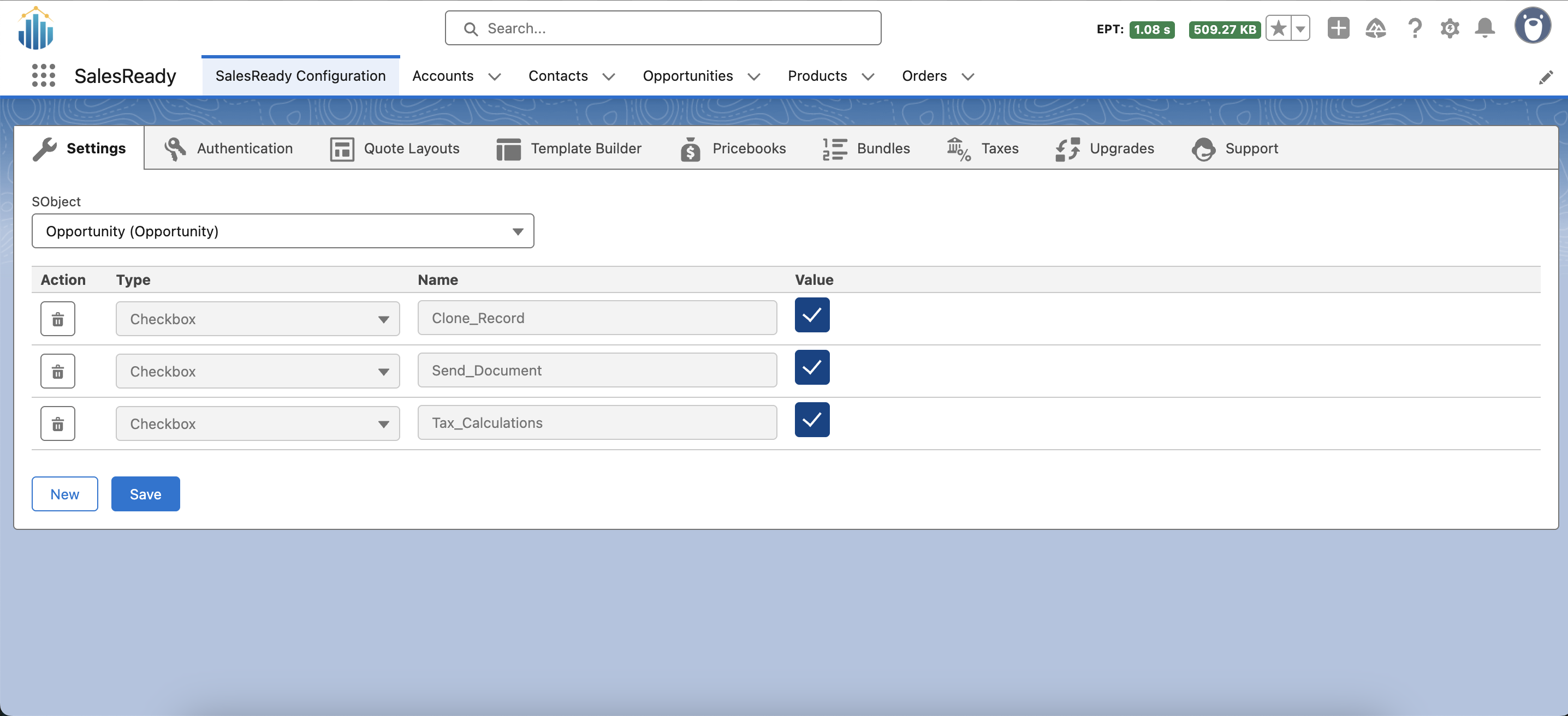

Apply the

Tax_Calculationsdynamic checkbox on the object where you want to calculate sales tax.-

This enables the Sales Tax button that gets displayed when building your quote or billing record.

-

📕 Check the box before saving on the screen below.

SalesReady Dynamic Settings

-

-

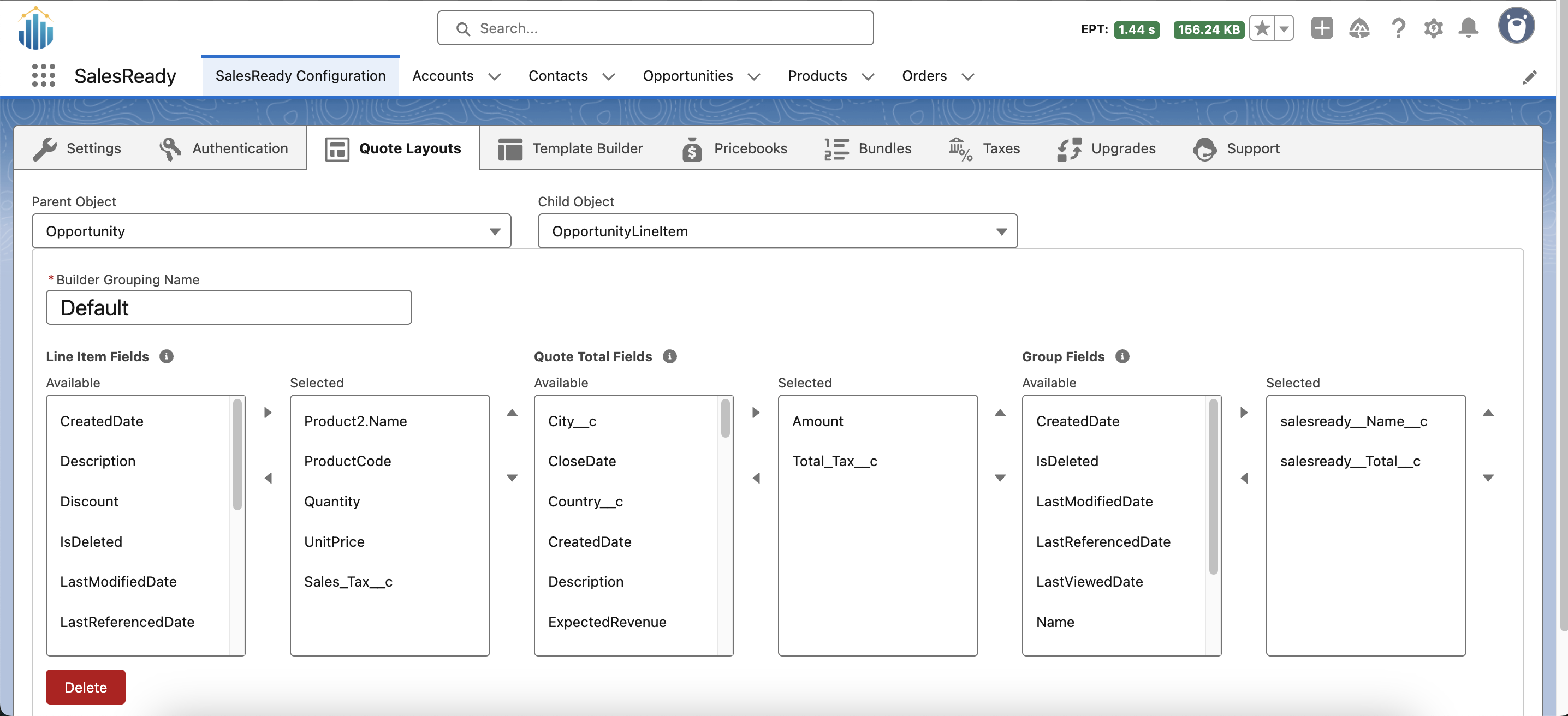

Configure the quote builder on the object where you want to calculate sales tax.

-

Depending on the object you choose, it is recommended to use or create a taxable field on both the line item and parent object. In the below example,

Sales_Tax__con the OpportunityLineItem rolls up to theTotal_Tax__cfield on the Opportunity. -

The

Sales_Tax__cfield is going to be directly applicable to your Anrok mapping scenario.

SalesReady Layouts

-

-

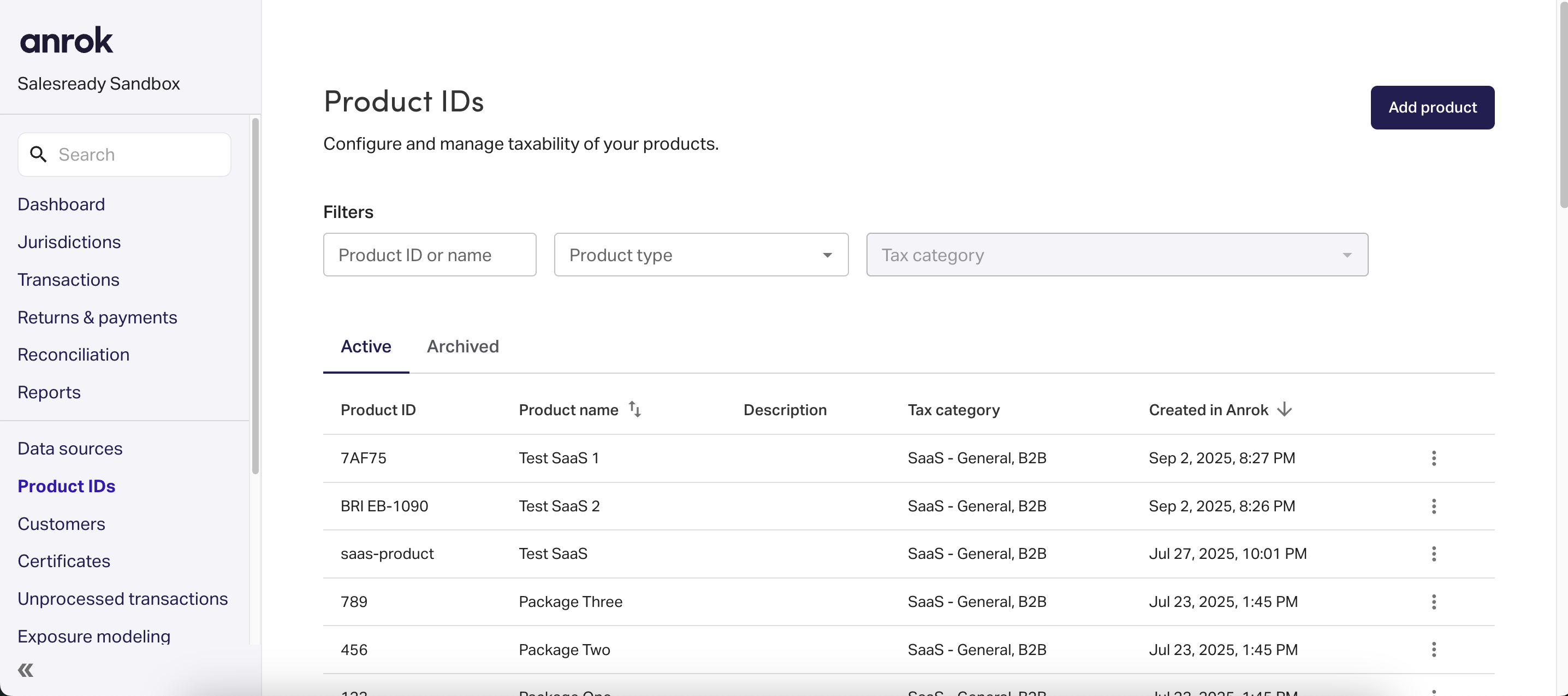

Create products in the Anrok portal.

-

Create products based on Anrok tax categories and please make sure to note each

Product ID.

Anrok Product IDs

-

-

Create API key(s) in the Anrok portal.

-

📕 Document your key in a secure way so that it can be migrated to the SalesReady configuration.

Anrok API Keys

-

-

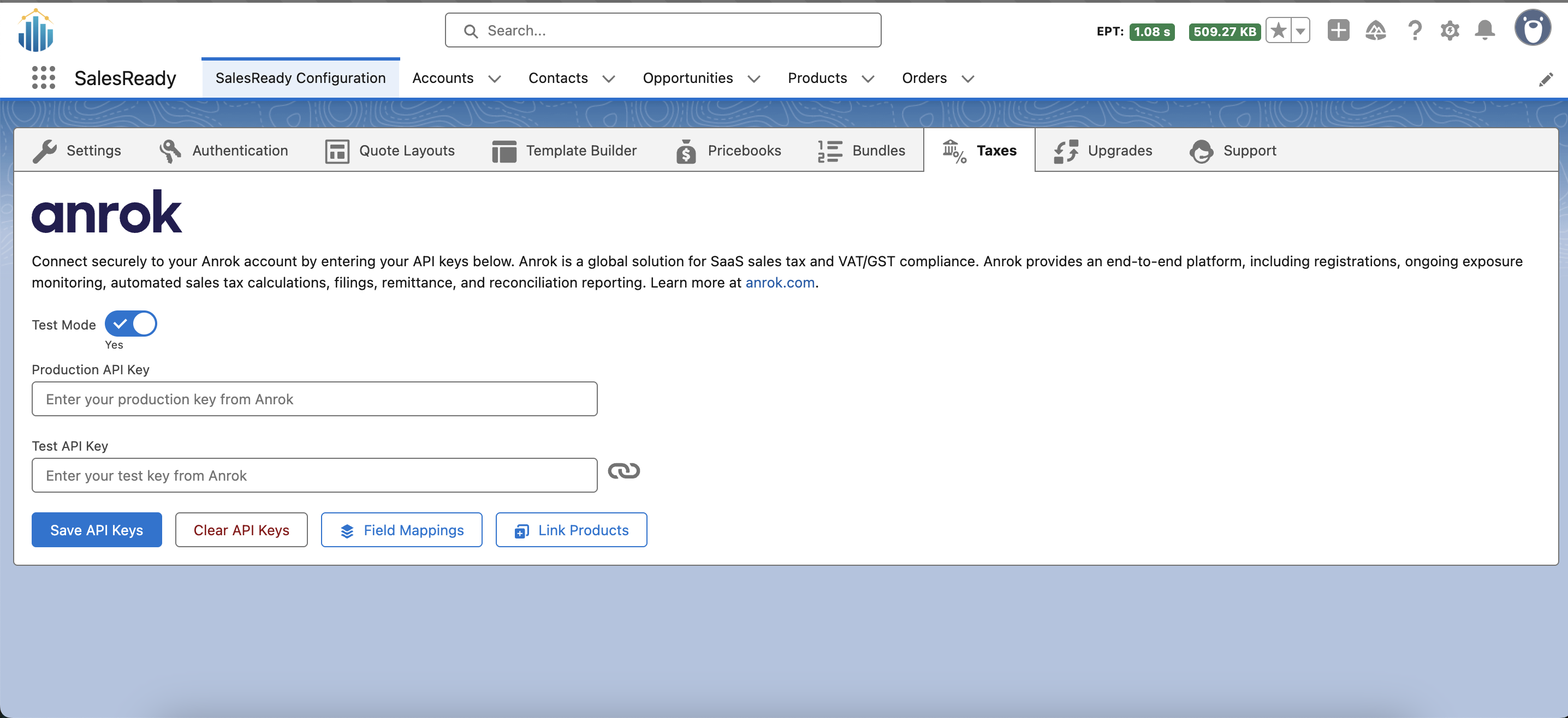

Add your API key(s) to the Taxes sub-tab within the SalesReady Configuration tab.

-

📕 Toggle

Test Modewhile you are testing.

SalesReady & Anrok Configuration

-

-

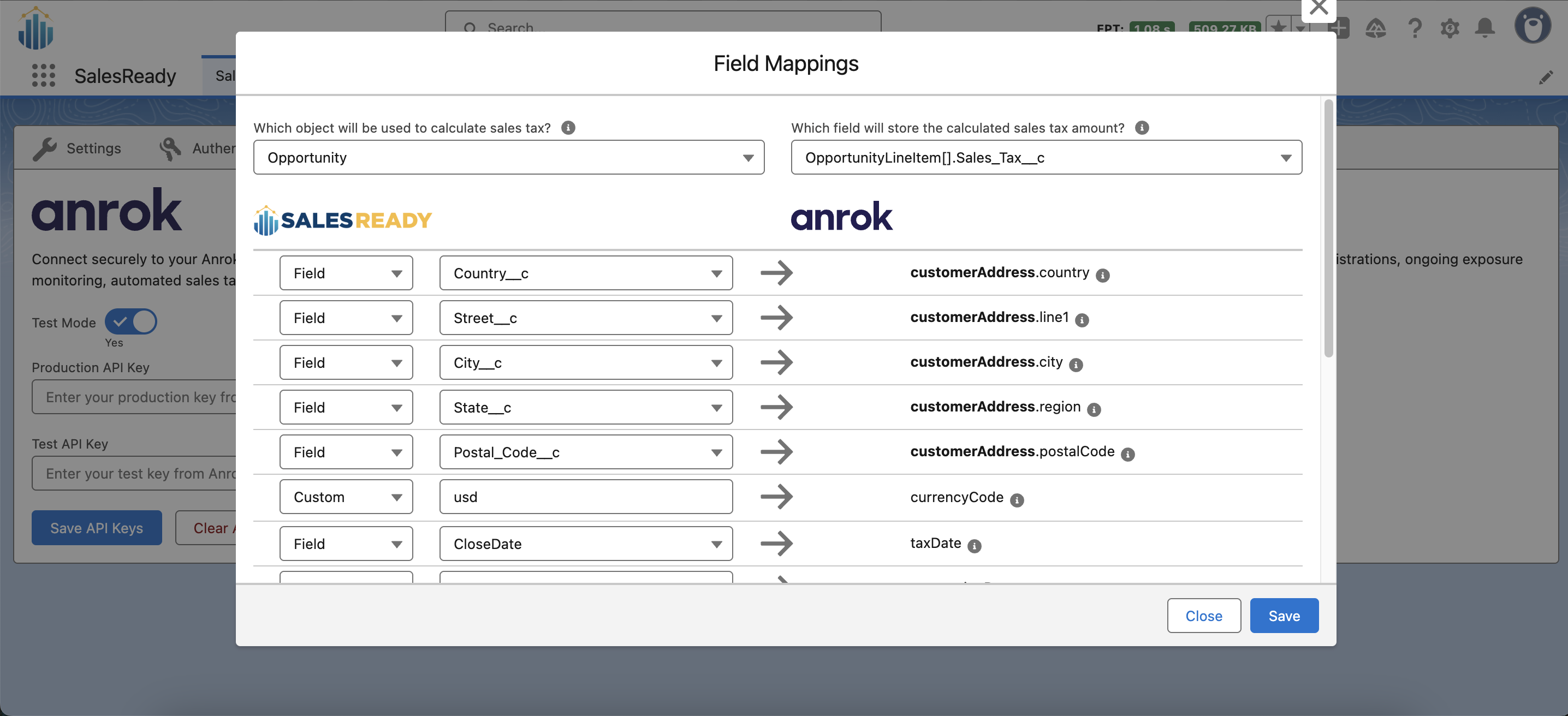

Apply your field mappings between SalesReady and Anrok.

-

Click the Field Mappings button.

-

Use the object you selected in Steps #1 and #2.

-

Use the field that was added to the quote layout. In this example,

Sales_Tax__con the OpportunityLineItem. ⚠️ This field does not have to exist on the layout in order for SalesReady to capture the calculated sales tax. However, it must be applied in this step. -

Choose your Salesforce field to map to Anrok.

-

📕 Hover over the help text for each field to clarify what each field means.

SalesReady & Anrok Field Mappings

-

-

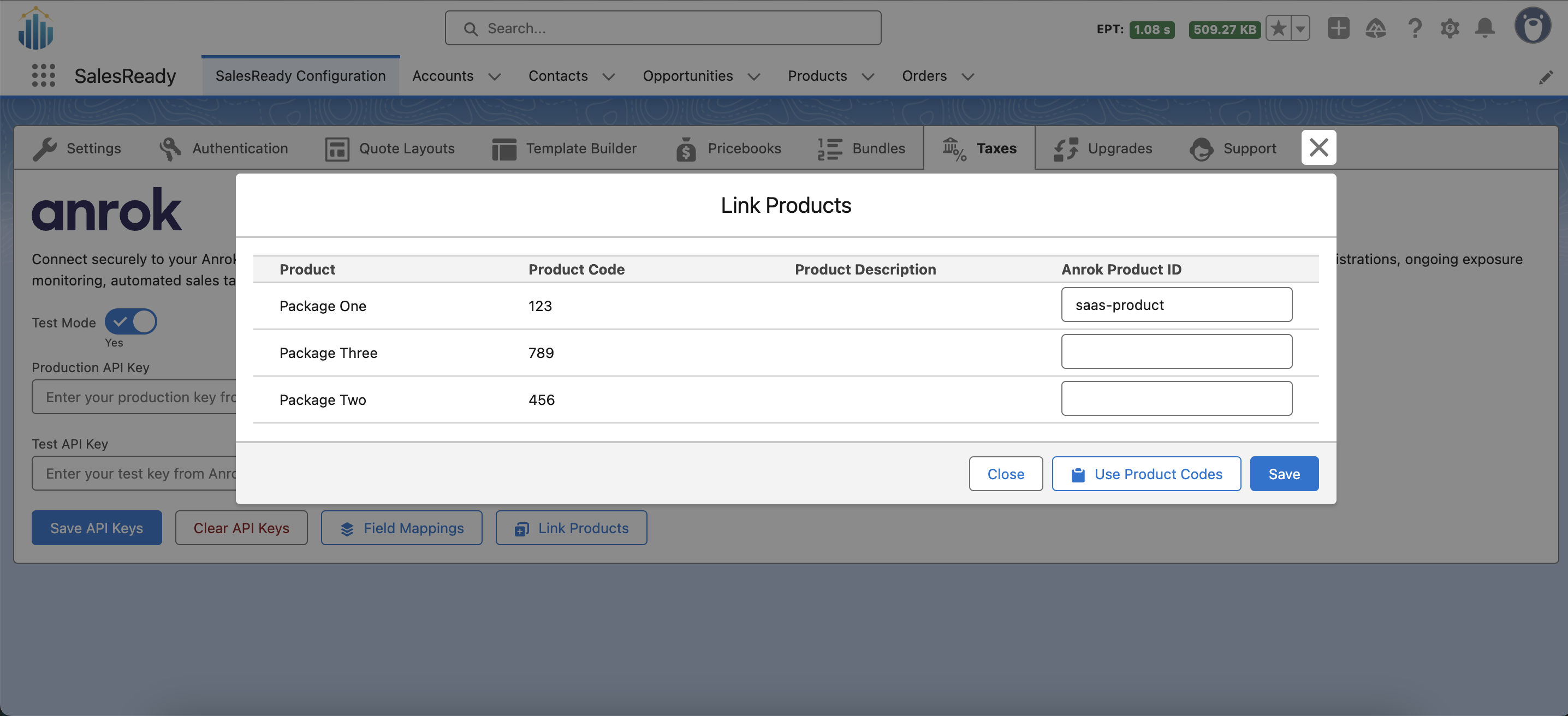

Link your Salesforce products to Anrok.

-

Click the Link Products button.

-

The

Anrok Product IDcolumn maps to theProduct IDsfrom step #3. -

📕 The

Product CodeandAnrok Product IDon this screen do not have to match. However, it is a best practice to make them the same. The Use Product Codes button helps easily copy and paste those IDs.

SalesReady & Anrok Product Mappings

-

How to use the SalesReady + Anrok integration (Manual)

-

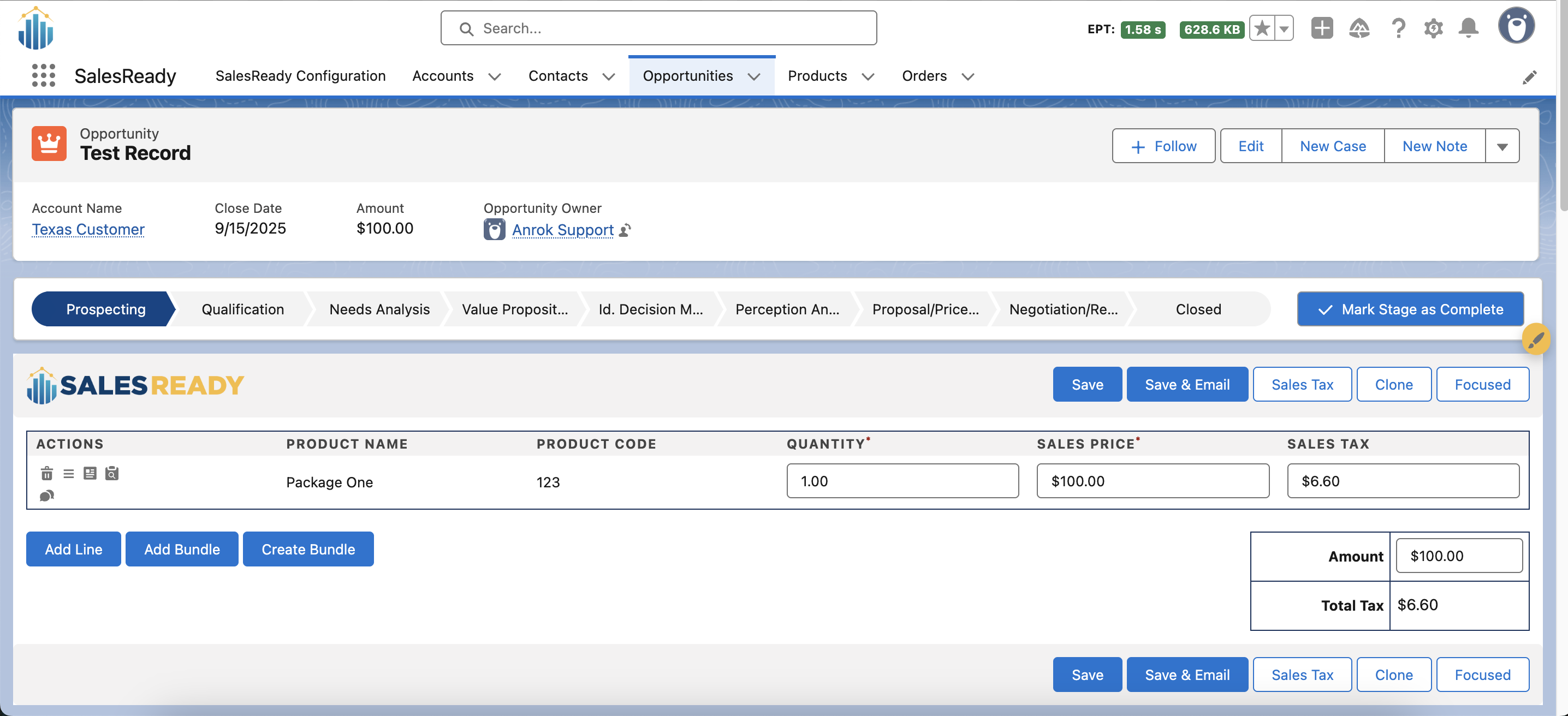

Open or create a record that has the

SalesReady Quote Containercomponent embedded on the Lightning Record Page. For more information please go to the Quote Builder section. -

Confirm that the Sales Tax button is showing in the builder.

SalesReady Quote Builder -

Use SalesReady as designed to build out your quote or billing record.

-

📕 As you make changes in real-time, the Sales Tax button becomes disabled. Once you save the record it will then be re-enabled.

-

-

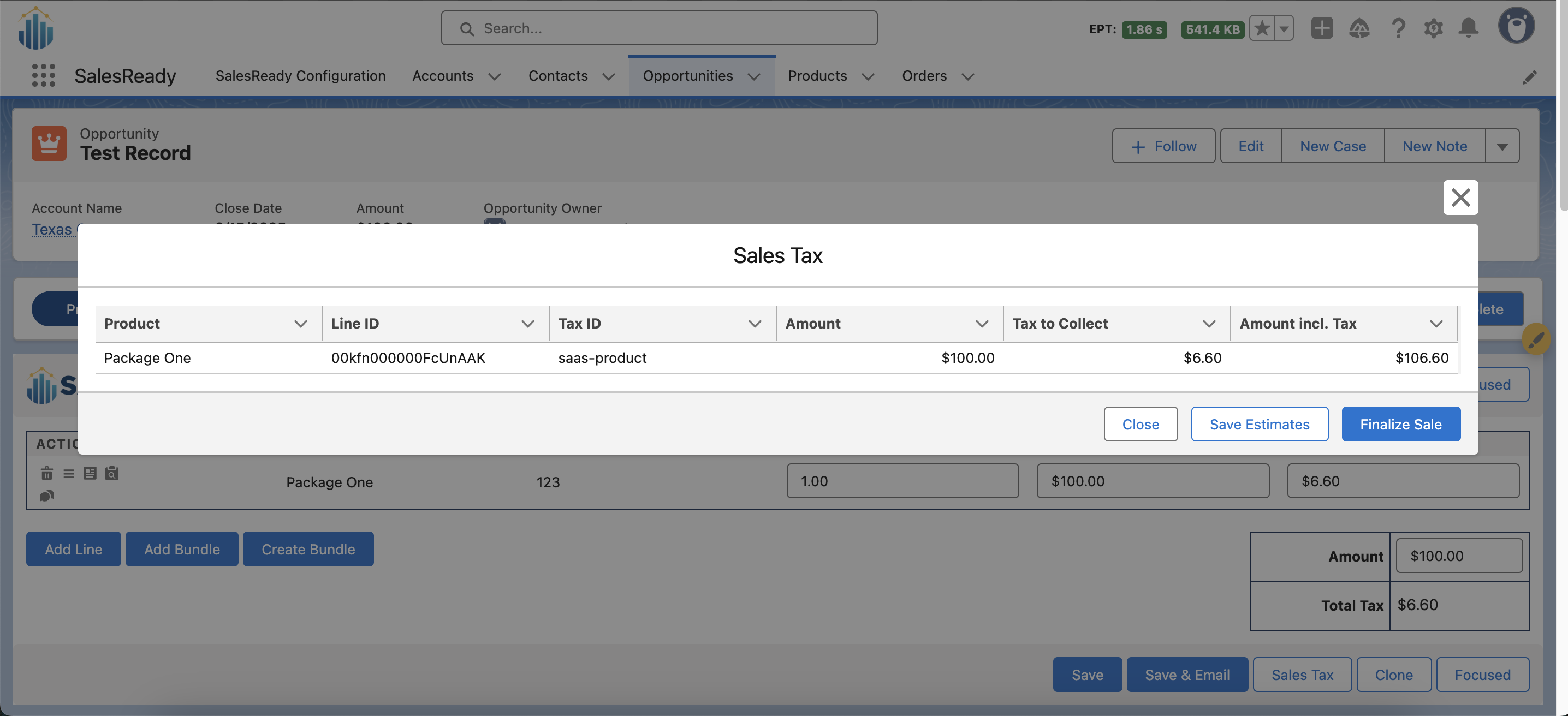

Once done building your record click the Sales Tax button.

-

Sales tax gets calculated as soon as you click the button.

-

The window displays each line and the applicable tax.

-

-

Save your tax estimates by clicking the Save Estimates button.

-

📕 This button will only save the calculated tax in Salesforce. ⚠️ Anrok will not use this transaction type to file sales tax returns or monitor sales thresholds.

-

You can save estimates as many times as needed based on changes to the quote or billing record.

-

-

When you want to finalize sales tax click the Finalize Sale button.

-

This button will save the calculated tax in Salesforce. Anrok will also use this transaction type to file sales tax returns and monitor sales thresholds.

-

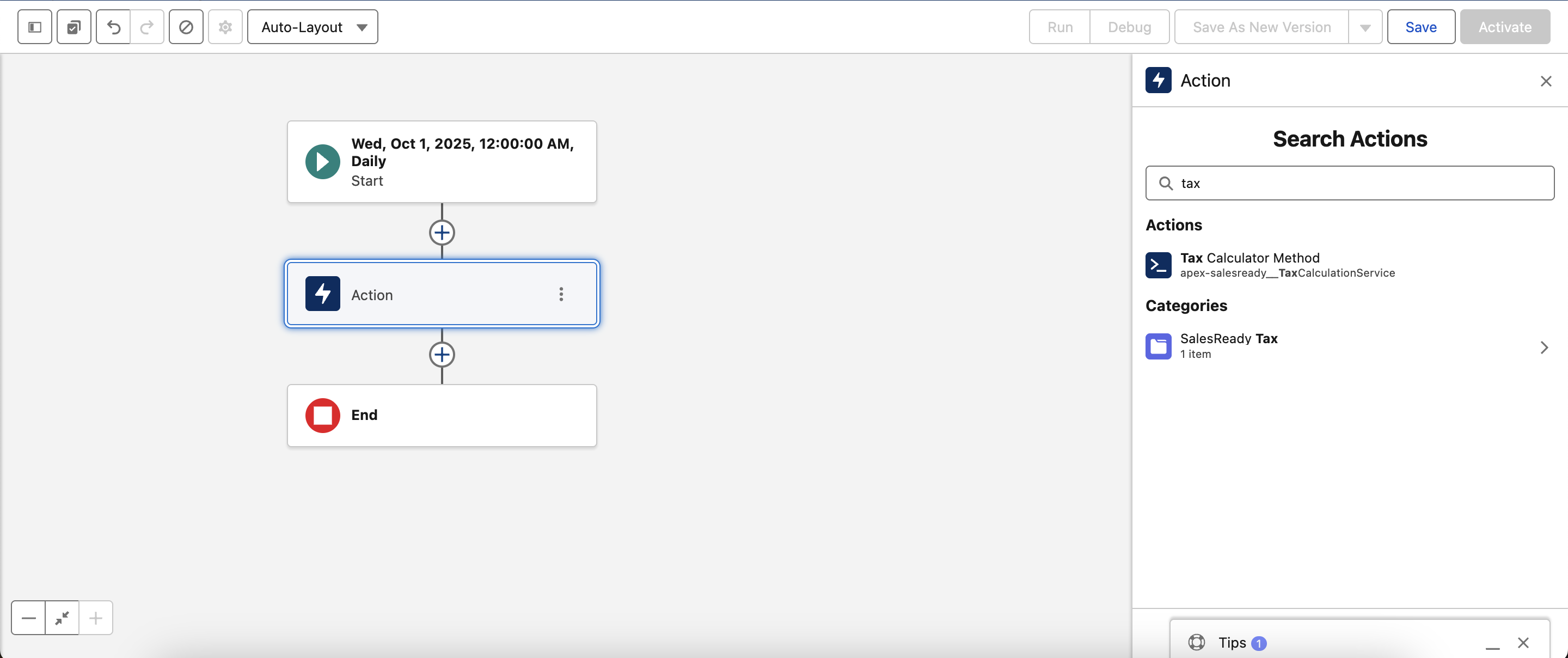

How to use the SalesReady + Anrok integration (Automated)

-

Taxes can be calculated from either a Flow or Apex. The process will run asynchronously and store the results in the mapped tax response field, as well as the values in the

salesready__SR_Line_Item__cobject. The applicable fields are:-

salesready__Sales_Tax__c- Calculated tax -

salesready__Refunded_Voided_Sales_Tax__c- Negated tax -

salesready__Combined_Sales_Tax__c- Combined calculated and negated tax -

salesready__Error_Log__c- The latest error to occur during process, if applicable

-

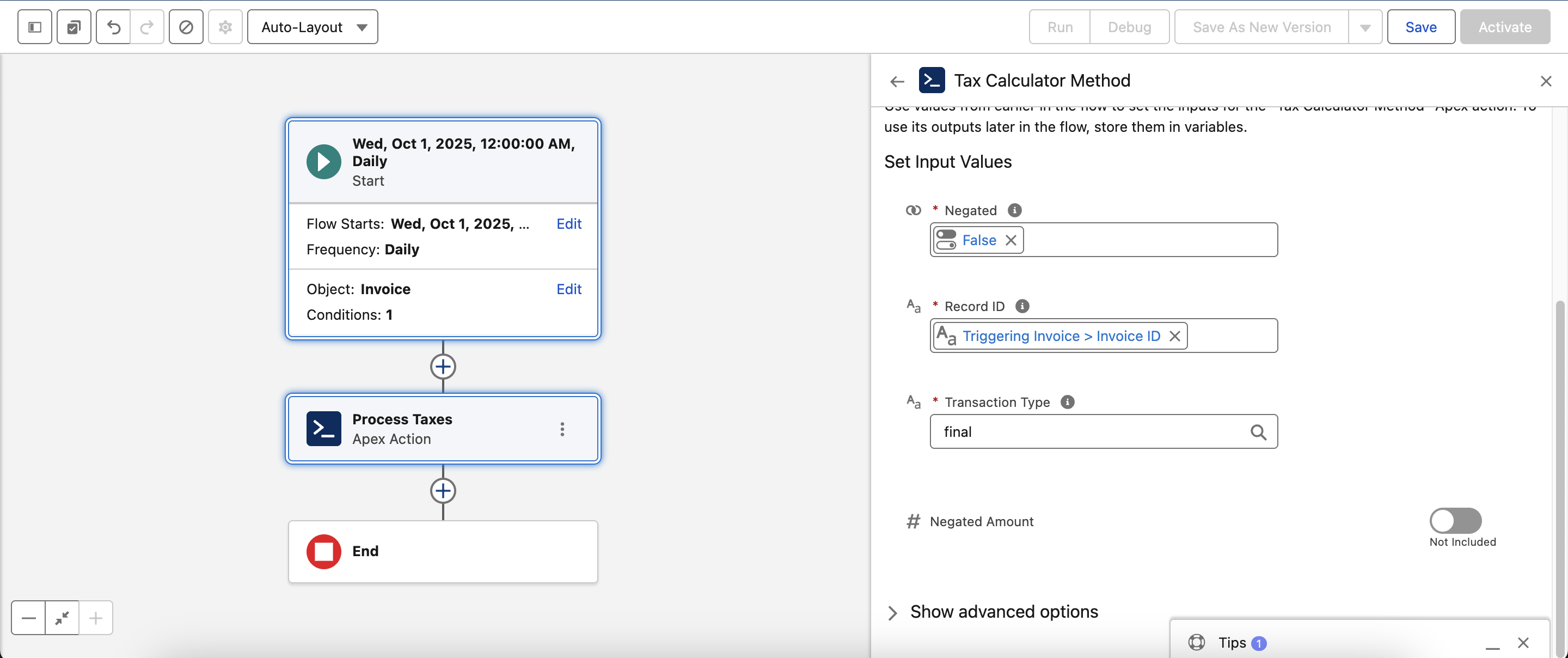

-

A Flow can call the

Tax Calculator MethodAction.-

Search for the SalesReady Tax category

-

Simply pass in the Record ID, the transaction type (estimates or finalized records), and then any negation information (only applicable to credits).

-

-

Apex can also pass in a list of IDs with the same information that gets passed in from the Flow.

-

TaxCalculationService.processTax(List<TaxCalculationServiceObj>). This method is void and the list contains the following fields for each record:-

recordId -

transactionType -

negated -

negatedAmount

-

-

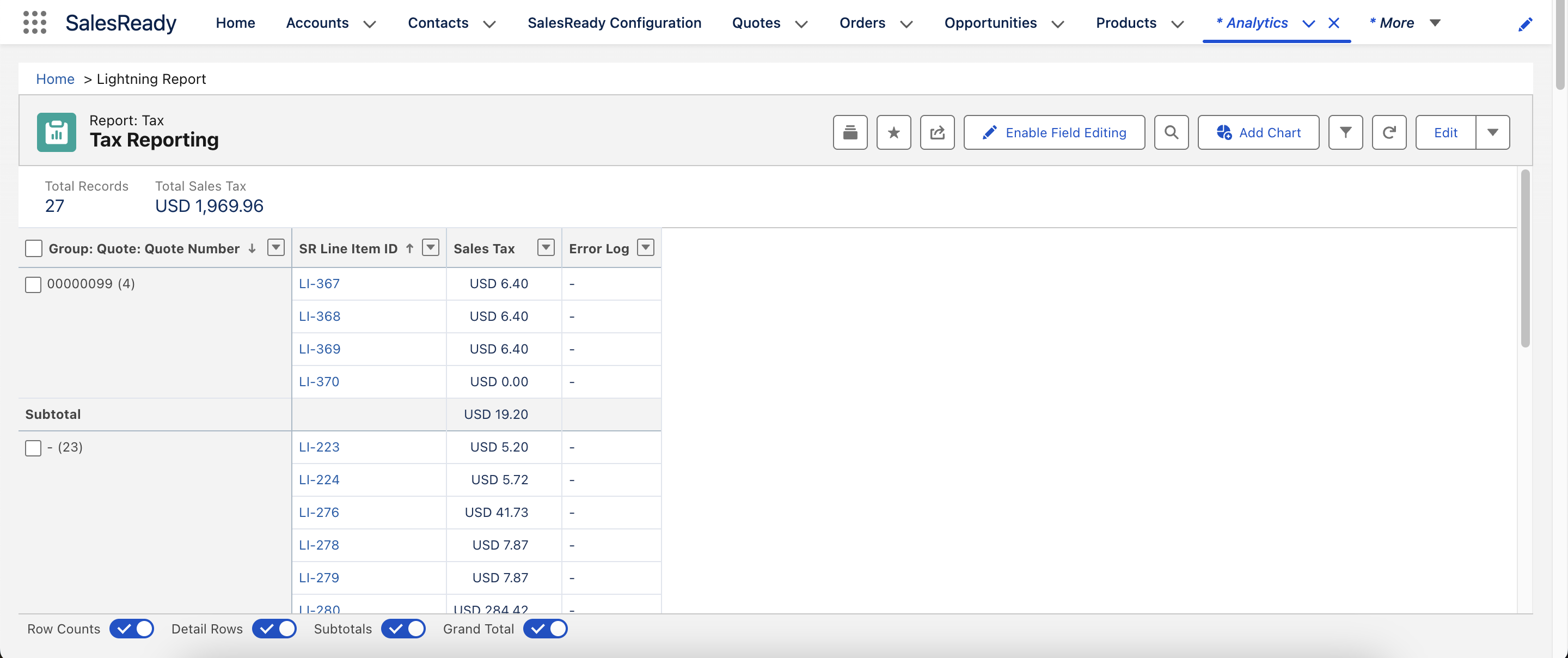

How to monitor tax reporting & logging in Salesforce

-

The

salesready__SR_Line_Item__cwill return any finalized tax information, as well as any errors logged for each record. If an error occurs for one line item you can expect to see the same error for the other line items as well.